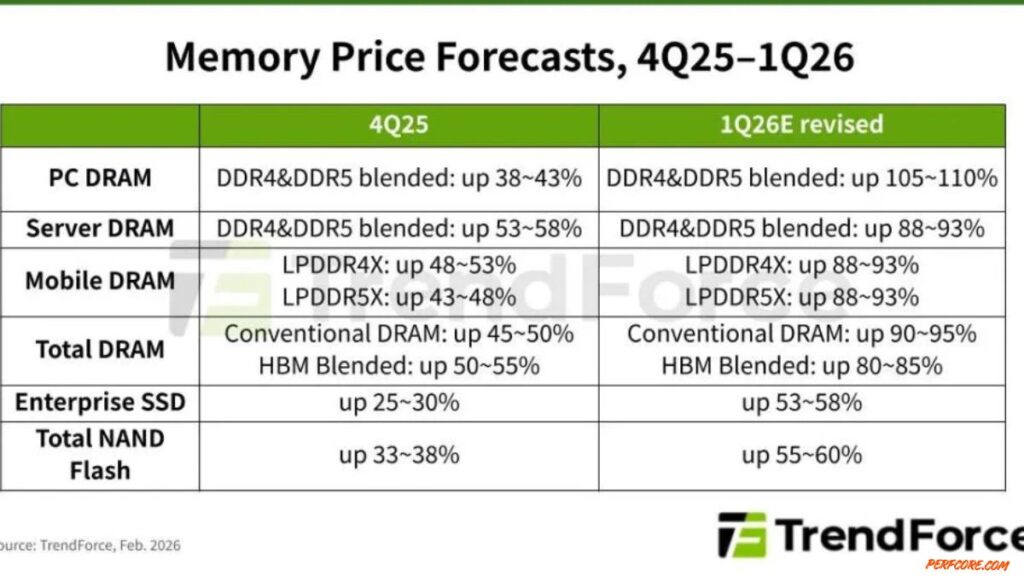

RAM price forecasts double for the first quarter of this year

The semiconductor industry had been warning, and clearly demonstrating, one of the worst crises in recent years, if not the most significant one to date. All of this has been driven by demand for artificial intelligence that shows no signs of slowing down. Now, according to data from TrendForce, one of the most influential consulting firms in the market, a concrete figure has finally been put on this situation.

In the current scenario, according to cost forecasts for DRAM and NAND flash memory, the balance between supply and demand has broken down like never before in the market. Faced with unprecedented demand, manufacturers are prioritizing the production of memory for servers and AI applications, leaving the retail market, where we participate as buyers, in a very marginal secondary position.

This shortage is not a temporary phenomenon, but rather a new market structure in which production capacity cannot keep pace with final orders. How does this translate in practical terms. For users, it means inflationary pressure that will push any electronic device to record price levels.

A 95% jump in DRAM prices

The figures presented in TrendForce’s latest report are simply discouraging for anyone planning to buy a PC in the coming months. Price forecasts for DRAM have been revised, and what previously pointed to a 55–60% increase is now expected to reach between 90% and 95% quarter over quarter. In other words, by the end of March, prices will be almost double what they were on January 1.

In the specific case of PC DRAM memory, analysts project that price increases could exceed 100% without hesitation, effectively doubling compared to the beginning of the year. This would represent the largest quarterly increase ever recorded in the industry.

As a result, this scenario places PC manufacturers in an extremely precarious position. Even companies that had secured supply agreements are experiencing dangerously low inventory levels. In a market entirely dominated by sellers, buyers lose all negotiating power, meaning the additional costs are passed on almost immediately to the retail prices of laptops and components. Even in the mobile market, where LPDDR4X and LPDDR5X memory is essential, price increases of around 90% are expected, which will also impact the manufacturing costs of mid-range and high-end smartphones.

NAND storage and enterprise SSDs

NAND flash memory, the core component of SSDs, is not being spared from this price escalation. TrendForce has raised its forecasts from an initial maximum increase of 38% to a much steeper 60%. In this case, the market is facing a double challenge.

On one hand, demand for AI applications has sharply increased SSD orders from cloud service providers in North America. On the other hand, memory manufacturers are redirecting part of their NAND production capacity toward DRAM, which already offers stronger profit margins for producers.

This dual pressure has pushed the supply of storage chips into an unsustainable bottleneck situation for end consumers.

As for the server market, the situation is described as one of intense competition. Large buyers are locked in a fierce battle to secure the greatest possible amount of memory, a dynamic that has driven server DRAM prices up by 90%. Enterprise SSDs have also experienced historic price increases of up to 58%.

In conclusion, for the end consumer, we are entering a rising price cycle in which storage drives and RAM will once again be the components that most significantly increase the cost of purchasing a new system. This situation appears unlikely to improve, at least until the second half of this year.

Journalist with a solid career path that began in 2020. Since then, my professional work has always been closely connected to the technology sector. My academic background includes a Bachelor’s degree in Journalism from New York University (NYU), which laid the foundation for everything that followed. I later earned a Master’s degree in Creative Writing from Stanford University, and my passion for artificial intelligence led me to complete the course “Google AI for Anyone.”

My central passion is video games, which is why I also completed a postgraduate program in eSports Journalism. The key to my work is always seeking a critical, and above all, well-grounded perspective to understand how technology is shaping a new world that is just around the corner